What tells you it’s time to invest in a home now?

- falling mortgage rates, and

- soaring prices of existing homes

Although the two trends seem contradictory, for home buyers they actually work together to solve the common issue – building an affordable home. A low rate of interest is by far the most important factor in the final decision to build a home.

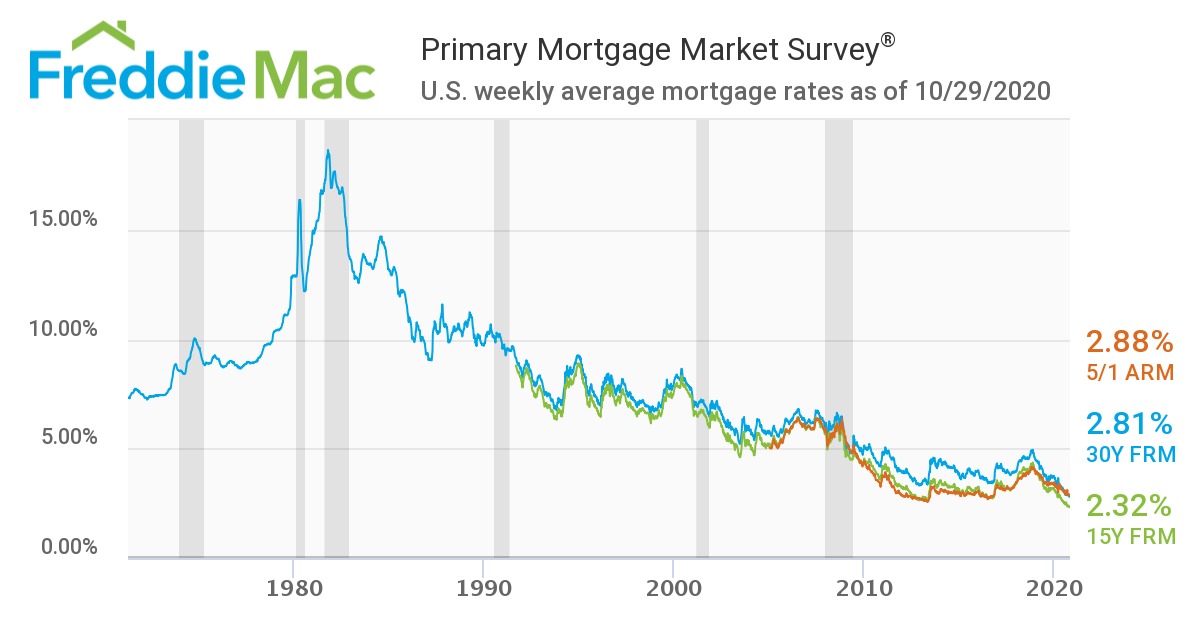

Mortgage rates are at a record-low

If you have always dreamt of buying your own home, there is no time like the present. Financing is more affordable just now. Mortgage rates are at an all-time low. In fact, this is the lowest it has ever dropped in three decades. According to Freddie Mac, banks are rolling out cheaper loans. FRM rates have plunged by one percentage point as a norm as seen in June: 3.13% (30-year FRM) and 2.59% (15-year FRM).

For prospective buyers, it means that mortgage repayment is less expensive. If you take out a home loan now, you can lock-in this rate and be assured of a low, predictable monthly outflow, irrespective of market fluctuations.

Let’s do the math:

In Jan, an interest rate of 3.72 % on a mortgage of $300,000 could set you back by $1,384 every month. With a lowered rate in June (3.12%), you pay $1,284. Jingling away in your kitty is a neat saving of $100 each month, or $1,200 a year.

There is no doubt that lending rates have fallen. Nowhere in history has this rate been as low as it is currently. If you need more information, do your own research on the top American banks like Wells Fargo, Bank of America, or JP Morgan Chase to find more about falling mortgage rates. Or, you may talk to a trusted builder to find out if they have any preferred lender to help you pre-qualify.

However, there are no projections that rates are going to go further below. Besides, as the market picks up and the availability of homes rises, the tables are going to be turned.

Property prices have risen steadily

Contrary to predictions, house prices are continuing to surge. Even the pandemic couldn’t put a dent in the housing market. If anything, rates have increased two-fold since last year. So, you can safely discard any thoughts of bargain-buying your dream home. In the near future, housing projections show a rise in housing costs brought about by both an insufficient inventory and demands for new homes. Hence, housing pundits are encouraging prospective homeowners to put in the money now lest prices swell out of reach.

Apart from borrowings, a surety of earnings also affects buying decisions. The pandemic has wiped away thousands of jobs and although the market has been recovering since May, most Americans are staring into an insecure employment scenario. Hence, before applying for a mortgage, the one thing first-time homebuyers must ensure is their ability to repay it. Interest rates are, for the first time in housing history, at their lowest level but this should not be the sole reason to burden yourself with a house loan.

Hence, if you are financially ready for investing in the new home of your choice (loss of employment is not a major concern for you now and you have enough dough in the bank) it is only practical to buy the same house at a lower interest rate.

Personalized homes in the Valley

Buying a custom home in south Texas is a safe option given the condition of the housing market. Many homes have been pulled out of local listings and house prices are predicted to rise further. Experts suggest that building a new home with low interest rates in mind could help you increase savings on your EMIs.

Three premium residences – Castle Lux, Royal Grande, King Marques – are built-to-order homes that speak of architectural finesse. These residential spaces carry some of the highly-priced characteristics of first-class homes:

- guarantee of quality

- attention to details

- network of reliable financers

- strong community of existing buyers

- foundation built over a decade of expertise

Trevino Construction can further lower your house-building expenses by helping you save more. Combined with dreadfully low interest rates, a Castle Lux home can earn you almost $1,200 every month.

Apart from assisting customers with checking out their eligibility for mortgages, we also help you get the most affordable interest rates for your budget. For instance, a Royal Grande home is designed to save as much as $1,500 per month and the savings extend to cover taxes and insurance.

We also have a unique system to arrive at the final cost of your property. Rather than selling at per square foot of space, we factor in all the exclusive elements that went into the building. A fully customized Kings Marque home will squeeze out $1,800 a month from your monthly loan bill.

Overall, if you find a home that appeals to your aesthetic and practical selves, go invest in it now rather than wait. The country is in a state of an unprecedented period of recession and no one knows where the end lies.

Waiting further in the hopes of even lower rates may prove futile since a lot of factors determine the trends. Take advantage of a rate cut in mortgage and reach out to us today to start building an exclusive, premium home for your family.